Employer payroll cost calculator

Plans Pricing How it Works. Payroll for all worker types.

Payroll Calculator Calculate Costs Of Hiring Staff In Latin America

We calculate file and pay all federal state and local payroll taxes on your behalf.

. The Employer NI Calculator allows you to calculate Employer National Insurance Contributions NICs and understand true cost of an employee. Ad Payroll Is Not Easy but Weve Got the Process down to a Fast and Easy Job. Taxes Paid Filed - 100 Guarantee.

Ad Compare This Years 10 Best Payroll Services Systems. The calculator will show the company and employee cost for each benefit and calculate taxable wages after pre-tax deductions for payroll taxes. Free Unbiased Reviews Top Picks.

Ad Process Payroll Faster Easier With ADP Payroll. Check all data is complete via accuracy engine. Ad See How MT Payroll Services Can Help Streamline And Grow Your Business.

Annual Employee Labor Cost Without Taxes or Overhead 2 Employee Hourly Rate x Annual Hours Worked Annual Employee Labor Cost Annual Overhead 3 Annual Building Costs. Our online service is available anywhere anytime and includes unlimited customer support. The True Cost section will show the actual cost per year per day and per hour and show the multiple of salary.

It will show you what. Ad Compare This Years Top 5 Free Payroll Software. We at Experlu enjoy making tax calculators as.

It is so simple you only need to enter your. For example if John has a basic salary of 10000 per year and receives an annual bonus of 1000 then his employer has paid him a total of 11000. Payroll Tax Calculator Determine the right amount to deduct from each employees paycheck.

Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Read In-Depth Reviews Here. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

Basic Annual Salary and Hours Enter the contractual Basic Gross. 2995 allows you to add bonuses and taxable benefits in addition to wages. Shouldering the Burden of Doing Payroll Can Distract You from Your Main Duties.

Get Started With ADP Payroll. Compliance and AI. Jo Landers does not guarantee the.

Summarize deductions retirement savings required taxes and more. Subtract 12900 for Married otherwise. How to File Your Payroll Taxes.

It calculates the labor cost including the salary and all security payments. Ad Process Payroll Faster Easier With ADP Payroll. Learn More About Our Payroll Options.

The Excel Version of the Employee Cost Calculator cost. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. In that instance you would calculate gross pay like this 40 hours worked x.

40 hours worked x 14 per hour 560 Lets say that same employee worked 45 hours the following week. Enter the monthly cost and company. This calculator will tell you.

Free Unbiased Reviews Top Picks. Ad Search For Employer Payroll Calculator Now. The calculator includes options for estimating Federal Social Security and Medicare Tax.

Ad Easy To Run Payroll Get Set Up Running in Minutes. Prepare your FICA taxes Medicare and Social Security monthly or. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. Get Started With ADP Payroll. If you want a.

When you think about adding a new employee to your payroll determine what the actual financial cost of doing so means to your business. Our payroll cost calculator quickly calculates your total payroll costs including the social insurances and GHS GESY contribution per year. Simplify Your Employee Reimbursement Processes.

Discover ADP Payroll Benefits Insurance Time Talent HR More. 2020 Federal income tax withholding calculation. View FSA Calculator A.

On top of that the employer will. How Much Does An Employee Cost. Employees cost a lot more than their salary.

Find More Time to Focus on Whats Important to Your Business. Calculate your startup costs. Our employee cost calculator shows you how much they cost after taxes benefits other factors are added up.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Calculate the cost of hiring someone If you are an employer use our online salary calculator to see exactly how much an employee will cost based on their salary.

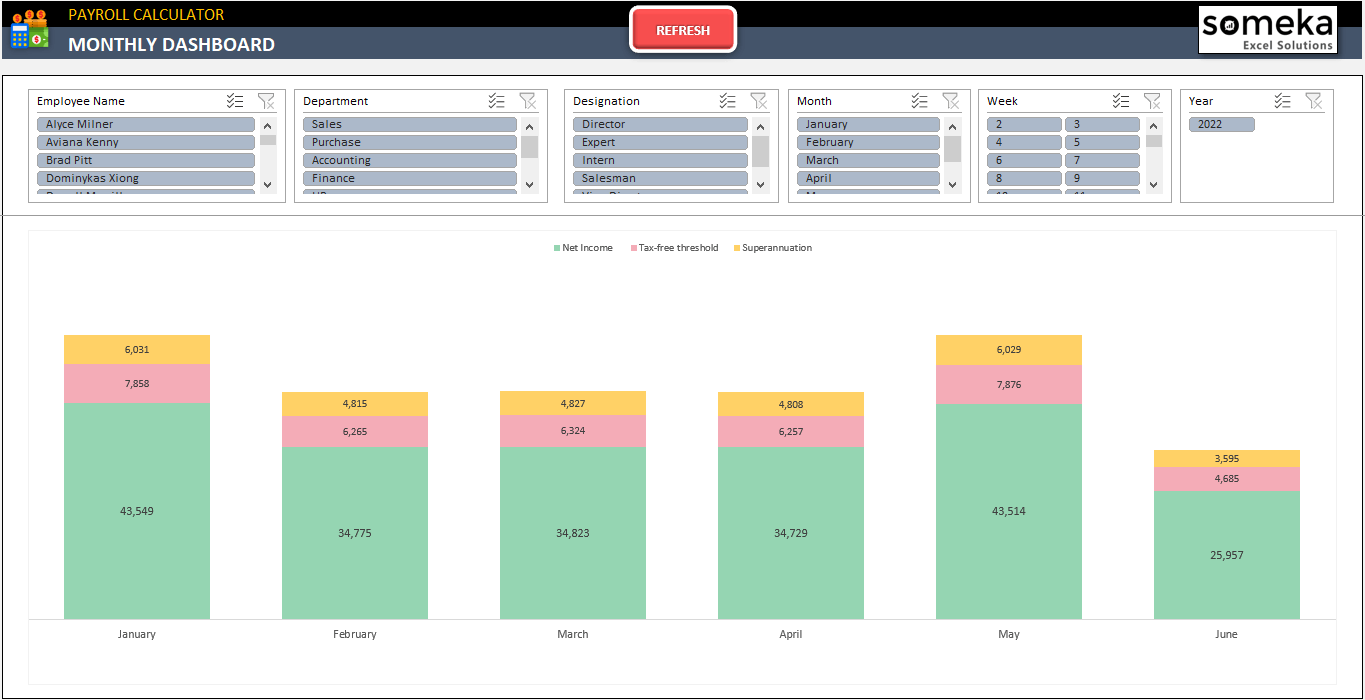

Payroll Calculator Free Employee Payroll Template For Excel

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Pin Page

Download Employee Turnover Cost Calculator Excel Template Exceldatapro Employee Turnover Employee Recruitment Employee Onboarding

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Attendance Sheet Template

How To Set Your Salary As A Business Owner Payroll Taxes Payroll Hiring Employees

Payroll Tax Calculator For Employers Gusto

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Download Total Compensation Spend Rate Calculator Excel Template Exceldatapro Payroll Template Compensation Calculator

Employee Cost Calculator Updated 2022 Employee Cost Calculation

Payroll Paycheck Calculator Wave

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

Salary Calculation Sheet Template As The Name Indicates Is A Spreadsheet That Helps Calculate Each Employee Payroll Template Spreadsheet Design Excel Formula

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp